How Much is Your Diminished Value Cash Back?

How Much is Your Diminished Value Cash Back?

We Provide Automobile Diminished Value Appraisals in Los Angeles County

What is Diminished Value?

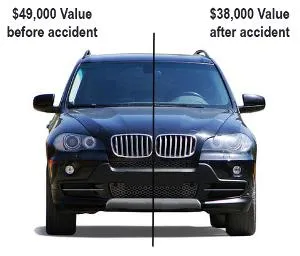

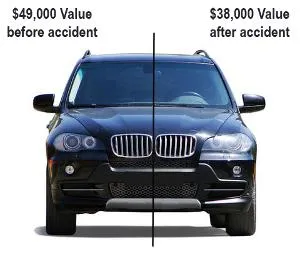

Diminished Value is the loss in a car's value after it has been in an accident and repaired. Even if your car has been restored to its original condition, it may still be worth less due to the stigma attached to a vehicle that has been in an accident. Value is determined by what a buyer is willing to pay, and most buyers would prefer a car that has never been in an accident. This means that you may receive less money for your car, even if the repairs were top-notch.

Obtaining a diminished value appraisal can provide a professional assessment of the loss in value and can be valuable evidence for negotiating a higher settlement with your insurance company. Protect your financial future and consider getting a diminished value appraisal.

What is Diminished Value?

Diminished Value is the loss in a car's value after it has been in an accident and repaired. Even if your car has been restored to its original condition, it may still be worth less due to the stigma attached to a vehicle that has been in an accident. Value is determined by what a buyer is willing to pay, and most buyers would prefer a car that has never been in an accident. This means that you may receive less money for your car, even if the repairs were top-notch.

Obtaining a diminished value appraisal

can provide a professional assessment of the loss in value and can be valuable evidence for negotiating a higher settlement with your insurance company. Protect your financial future and consider getting a diminished value appraisal.

"I am a individual that was in an accident with a transportation company ( semi-truck). I did not have representation from an attorney and my diminished value claim was not questioned and quickly accepted. by the party at fault. Communication, responsiveness and the timeframe in which the service was provided was extremely professional. Highly recommended. Thank you, again."

Kevin E.

Why Get a Diminished Value Appraisal?

A diminished value appraisal is a professional evaluation of this loss. It can provide valuable evidence for car owners seeking to negotiate a higher settlement with their insurance company. In California there are laws that allow car owners to seek diminished value as damages. It is important for car owners to understand the laws in their state and to consult with a qualified appraiser if they are seeking compensation for diminished value.

As experienced appraisers, we encourage car owners to seek out a professional evaluation if they believe their car has suffered diminished value.

The Secret Insurance Companies Don't Want You to Know

If you've been in a motor vehicle accident, you may be entitled to compensation for your vehicle's decreased value, also known as diminished value. Unfortunately, many insurance adjusters will do their best to limit the amount they pay out. To ensure you receive the compensation you deserve, it's important to understand the concept of diminished value and have the necessary facts and appraisal to support your claim. Don't let the insurance adjuster succeed in paying less than your claim is worth. Take control of your claim by requesting your diminished value appraisal today!

"I am a individual that was in an accident with a transportation company ( semi-truck). I did not have representation from an attorney and my diminished value claim was not questioned and quickly accepted. by the party at fault. Communication, responsiveness and the timeframe in which the service was provided was extremely professional. Highly recommended. Thank you, again."

Kevin E.

How Much Diminished Value, LLC

Craig Broussard | Regional Manager

Mailing Address:

1976 S. LaCienega Blvd., #340

Los Angeles, CA 90043

Mon - Fri: 8:00AM to 5:00PM

How Much Diminished Value, LLC

Craig Broussard | Regional Manager

Mailing Address:

1976 S. LaCienega Blvd., #340

Los Angeles, CA 90043

Mon - Fri: 8:00AM to 5:00PM

Frequently Asked Questions

What is diminished value?

Diminished value refers to the loss in value that a vehicle experiences after it has been in an accident and repaired. Even if a car is restored to its original condition, it may still be worth less due to the stigma attached to a vehicle that has been damaged. The amount of diminished value can vary widely depending on the severity of the accident, the quality of the repairs, and other factors such as the age and make of the vehicle.

Why should I care about diminished value?

If you have been in an accident, there is a good chance that your vehicle has suffered a loss in value. You should be compensated for this loss, as it is better to receive reimbursement for the decrease in value now rather than feeling the frustration of losing money later when you try to sell or trade in the vehicle.

What is inherent diminished value?

There are different types of diminished value. Inherent diminished value is the automatic loss of market value to a vehicle simply due to the fact that it has been involved in an accident. It represents the amount that a vehicle is perceived to have decreased in value as a result of the accident.

What is repair related diminished value?

Repair related diminished value is the decrease in resale value to a vehicle due to poor quality repairs. There are two types of repair related diminished value: insurance related and shop related. Insurance related diminished value is the loss of value due to oversights and/or omissions by the insurance company on their appraisal or refusal to pay for specific repair procedures recommended by the body shop. It can also be caused by the use of inferior aftermarket replacement parts mandated by the insurance company. Shop related diminished value is the amount that a vehicle's value is decreased due to improper, poor quality, or incomplete repairs.

Our standard reports are designed to provide an affordable method to help you recover what you are entitled to from the at-fault party's insurance company. These reports provide evidence of inherent diminished value, but do not cover repair related. Repair related diminished value inspections must be done in person and are costly. Additionally, any discrepancies with repair related diminished value may be a matter between the repair shop and the consumer, or both the repair shop and insurance company and consumer, so pursuing a claim of this nature can be difficult and may require litigation. ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. here

What is the statute of limitations for pursuing a claim for diminished value in California?

The statute of limitations for pursuing a claim for diminished value in California is generally three years from the date of the accident. This means that you have three years from the date of the accident to file a lawsuit seeking compensation for the diminished value of your vehicle. It's important to note that this time period can vary depending on the specific circumstances of your case, so it's always a good idea to consult with an attorney to understand your rights and options. If you believe you are entitled to compensation for the diminished value of your vehicle, it's important to act promptly to preserve your legal rights.

What is the deadline for recovering diminished value in California?

The statute of limitations for pursuing a claim for diminished value in California is generally three years from the date of the accident. This means that you have three years from the date of the accident to file a lawsuit seeking compensation for the diminished value of your vehicle. It's important to note that this time period can vary depending on the specific circumstances of your case, so it's always a good idea to consult with an attorney to understand your rights and options. If you believe you are entitled to compensation for the diminished value of your vehicle, it's important to act promptly to preserve your legal rights.

What is a diminished value claim?

A diminished value claim is a request for compensation for the loss in value of your vehicle due to an accident. Insurance companies may not bring up the subject of diminished value and may try to minimize your claim as much as possible. To pursue a diminished value claim, you will need to provide documented evidence and may need to make a formal written demand. You may also need to negotiate a settlement with the insurance company.

Should I ask for diminished value? Is a diminished value claim really worth pursuing?

If you have been in an accident, it is worth considering pursuing a diminished value claim. Even if you do not plan to sell or trade in your car right away, the reduced value of your vehicle can still affect you in the long run. Many people are able to recover a significant amount of money through a diminished value claim, and the cost of pursuing a claim may be worth it in the end.

Do insurance companies cover diminished value in California?

If the accident was not your fault, then the insurance company of the at-fault party may be responsible for covering the diminished value of your vehicle. While a few states allow first party diminished value claims, California and the majority of states do not. A first party claim would be utilizing your collision or full coverage from your personal insurance company. Almost all insurance companies are aware that all states permit diminished value claims when someone else is at fault for the damages to your vehicle, however many adjusters will be reluctant to admit this and may argue otherwise in order to avoid paying a claim.

When do insurance companies pay for/compensate diminished value in California?

In California, someone must be at fault for you to file a diminished value claim. Different insurance companies have different policies and procedures when it comes to paying for diminished value. Some companies are more lenient while others may refuse to pay altogether, even if they know they owe it. In the latter case, you may have to file a lawsuit. Judges in California do award diminished value if you can effectively prove your claim.

What if I was responsible for the car accident in California?

Unfortunately, there is very little remedy in California if you were at fault for the accident. There are only a few states that will allow a first party (collision or comprehensive coverage) claim for diminished value. One option that may be available to you is to file a casualty loss, such as the diminished value of your vehicle, on your taxes.

Will I be able to collect diminished value from the insurance company?

Many people are able to collect diminished value from the insurance company after being persistent in pursuing their claim. However, some insurance companies may be difficult to deal with and may be reluctant to pay your claim. In these cases, a high quality and reputable appraisal can be helpful in supporting your claim. In some cases, you may need to file a lawsuit in order to collect the diminished value. Local courts generally award diminished value if you have proper documentation and support for your claim.

How do insurance companies calculate diminished value?

Insurance companies may use different methods to calculate diminished value. Some may use the 17 C formula or software to determine the amount of your claim. The 17 C formula is a formula that was developed in a Georgia class action suit against State Farm and is not necessarily applicable to all states. Many software programs are developed by programmers and may not provide a clear explanation of how the numbers are derived. It is important to keep in mind that these methods may not always provide a accurate or fair assessment of your diminished value loss.

Do I have the right to get my own diminished value assessment report?

Yes, you have the right to hire your own appraiser to help determine the diminished value of your vehicle. The insurance company of the at-fault party must consider your independent assessment. Judges often give strong consideration to evaluations from licensed, unbiased, and impartial appraisers. Having your own assessment can help support your claim and increase your chances of being compensated for the diminished value of your vehicle.

When should I make a diminished value claim?

It is usually best to wait until all repairs on your vehicle are completed before filing a diminished value claim. There may be additional damages or repairs discovered during the repair process, known as a supplement, which can increase the cost of repairs. If you file your claim too early, you may not receive full compensation for the diminished value of your vehicle. It is advisable to wait until all repairs are finished and all relevant information is available before making a claim.

Why am I just learning about diminished value now?

In the past, it was difficult to determine the accident history of a vehicle without a thorough inspection by an expert. People often did not learn about diminished value until they tried to trade in their car. However, advances in technology have made it easier to track accident history, and it is now rare for an accident to go unrecorded in a vehicle history report. Companies such as CARFAX and AutoCheck offer vehicle history reports that may include details from police reports, body shop records, insurance company data, and other sources. While these reports can be helpful, it is important to note that they may not always be accurate.

What information is included in a vehicle history report about my car?

A vehicle history report may include information about the severity and location of damages to the vehicle, whether airbags deployed, and the extent of repairs. It may also include information from police reports, body shops, insurance companies, dealerships, salvage yards, and other sources. It is important to be aware that these reports may not always accurately reflect the full extent of damages or repairs to a vehicle.

If I think my accident will not be reported to CARFAX or Autocheck, should I still try to recover diminished value?

Even if your accident is not reported to a vehicle history company like CARFAX or Autocheck, it may still affect the value of your vehicle. Dealers and potential buyers may be able to tell if a vehicle has been in an accident through visual inspection or by using specialized tools to measure the thickness of paint on repaired panels. In addition, some states have damage disclosure laws that require you to report accident history to a potential buyer. It is always a good idea to try to recover diminished value if you believe your vehicle has lost value due to an accident.

Does the type of vehicle I have affect the diminished value?

Yes, the type of vehicle you have can significantly affect the amount of diminished value you may be able to recover. Trucks and other vehicles designed for rugged use may not suffer as much diminished value from minor accidents as more delicate vehicles. Luxury vehicles, in particular, may experience a larger loss in value due to their higher price and the demands of their buyers.

Will my vehicle’s age and mileage affect my diminished value claim?

The age and mileage of your vehicle can have an impact on the amount of diminished value you may be able to recover. Generally, newer vehicles with lower mileage are more likely to be able to recover a larger amount of diminished value, while older vehicles with higher mileage may be less likely to recover as much. This is not always the case, however, and the value of your vehicle may be influenced by other factors as well.

What accident factors affect my vehicle’s diminished value?

There are many factors that can affect the amount of diminished value your vehicle may be able to recover after an accident. These can include the severity of the accident, the location of the damages, the age and mileage of the vehicle, and the type of vehicle. It is important to carefully consider all of these factors when evaluating the potential diminished value of your vehicle.

How Much Diminished Value, LLC

Craig Broussard | Regional Manager

Mailing Address:

1976 S. LaCienega Blvd., #340

Los Angeles, CA 90043

Mon - Fri: 8:00AM to 5:00PM

How Much Diminished Value, LLC

Craig Broussard | Regional Manager

Mailing Address:

1976 S. LaCienega Blvd., #340

Los Angeles, CA 90043

Mon - Fri: 8:00AM to 5:00PM

Call or Text: (323) 745-8225

Call or Text: (323) 745-8225